My LOAN MAGAZINE

Home

blog categories

Some people maybe will choose to

take the loan to pay off credit cards. By choosing a personal loan that

has lower rates that they are paying on the credit cards, they can save some

money, but there are some things to consider before taking a loan to pay off

credit cards.

Some believe that when you take aloan to pay off credit cards is like a revolving dept. You borrow one to

complete one. It is almost the same. Revolving debt can be more dangerous for

your credit score and worse than installment debt. If you choose this way, you

may have converted revolving debt to installment debt. It can cause your scores

went up. Besides, the rate from the loan is not so different with the credit

cards. It depends on you to choose the secure an trusted loan. Some insecure

loan can cause some risks by the lenders. The lenders can put a very

high-interest charges. Some lenders are also looking for a person who has a good credit rating. If it's

not, you will be rejected.

When you want to take the loan to pay off credit cards, of course,

you will choose the loan that has lower rates, then after that, be sure that

you can handle the payments of the loan. Different with credit

card debt, a personal loan has a shorter time gradually than a credit card.

This condition can cause higher monthly payments. Don't make a transaction on a

payment schedule that you can't handle.

After you take a personal loan, you can immediately pay off your credit

card debt, it means that you have a new zeroed balances. Remember that you

still have to complete your loan debt, even though that it has lower rates. The

most important thing when you take the loan to pay off credit cards is to make

sure that you pay your loan debt in each month. The goal from this strategy is

to repay the principal and eliminate the debt. To use this way, you should make

a good money management to avoid a bigger dept from the loan, than the credit

cards.

Pepperstone is an Online Forex (FX) Trading Broker, providing traders across the globe with cutting edge forex trading technology to offer unmatched top tier liquidity, institutional grade spreads and the security of tight financial regulation. Pepperstone offers online forex trading through multiple forex trading platforms, including Metatrader 4, Webtrader and Apps for iPhone and Android.

Smart traders make smart decisions. Equip yourself with the Pepperstone advantage today.

1. Raw ECN Spreads from 0.1 pips

2. Industry leading $3.5AUD per 100k traded

3. 400:1 Leverage

4. $200 minimum deposit

5. Trade from 0.01 lots

Secure Fund

Client funds held in segregated trust accounts with AA Rated Australian Banking Institutions

Tip Tier Liquidity

Next-generation STP access to one of the largest pools of interbank liquidity in the world.

Metatrader 4

Trade using the Metaquotes MT4 Platform with no trading restrictions and lightning fast execution

RAGULATED

Open an account with a regulated firm, so you can focus on what's important: your trading.

How are my funds held with Pepperstone?

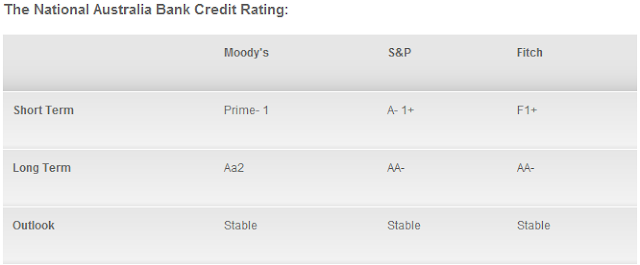

Your funds on deposit with Pepperstone are held in a trust accounts with the National Australia Bank, anAA rated Bank. Funds are established, maintained and operated in accordance with Australian client money rules.

License

Pepperstone Financial Pty Ltd holds the Australian Financial Services License AFSL 414530.

ASIC requires licensed financial services providers to meet strict capital requirements and to implement and comply with internal procedures including risk management, staff training, accounting and audits.

Trading with Pepperstone

Australian-based forex trading firm

Regulated under ASIC

Professional Indemnity Insurance with Lloyds of London

Professional Memberships

Pepperstone Financial Pty Ltd is a member of the Financial Ombudsman Service (FOS), which is an approved Australian external dispute resolution scheme that can deal with complaints about all of the financial services under its AFSL.

Segregation of Client Funds

All client funds are segregated into client trust accounts kept separate from the Pepperstone company funds.

Bank Accounts in Tier-1 Banks

All client funds are kept in the safest top-tier AA rated banks*.

*Pepperstone partners with The National Australia Bank, an AA Rated Ban

Working people are really struggling to make ends meet with the economy in such an uproar. If you are among those who have been hit really hard with a combination of escalating gasoline prices and soaring food prices, chances are you may be running a little short financially before you next payday rolls around. There are loans for people in your situation that can lend you a hand and keep your household running until you get paid again.

Money Today For Any Purpose

These loans are called payday loans. It is a short-term loan that can make a big difference for working people. They are easy to obtain and easy to repay. Although there may be walk-in stores in your area that service payday loans, you can get the best rates online, where lenders compete for customers.

The way they work is simple. You present your lender with a post dated check for the amount you want to borrow, plus interest and fees. The servicer will hold your payday loan for an agreed upon period of time, anywhere from two weeks to one month, which will coincide with your next pay day. When your payday loan becomes due, your post dated check will be deposited into your checking account in order to reimburse the lender for your money. It really is that simple.

Everyone Qualifies

The requirements to get a payday loan are so lax that nearly everyone can receive one. If you have income in the form of wages (or in some cases, even disability income) and a valid checking account that is not overdrawn, you can expect to be approved.

When applying, you will be asked to submit proof of your income in the form of recent paystubs, or other verification; a valid state issued drivers license card, proof of your residence in the form of a recent utility or phone bill, credit card statement, or other official piece of mail; and three personal references who will only be called if you should fail to repay the lender.

No Credit Check

There is no credit check required to receive a payday loan, which means that regardless of how bad your credit may be, you can still get the money you need today. Be aware, however, that payday loans do not report to the major credit reporting bureaus (unless you default), so this type of loan cannot be counted on to help build or rebuild your credit score.

Payday loans have gotten a bad reputation in recent years, with many claims that the interest borrowers pay is too high in relation to the benefit they receive from the loan. This interest is far less when you get your payday loan online, and it is notable that any payday loan, regardless of the interest that you must pay, is superior to the outcome of not having the funds to pay for things you must have - such as having your electricity shut off, not having gas to get to your job, or even writing checks that are returned for non-sufficient funds.

Commencing a new business or expanding an existing one is not a matter of joke. For all such needs, you need huge amount of funds. And it is almost impossible in the present world to arrange such huge amount on ones own. At such crucial point of time, an obvious choice is seeking refuge in some external source like applying for loans. But, you might be facing problem because of your bad credit.

These days, there is no dearth of lenders offering business loans, in spite of your bad credit record. Here are few tips on where to make your search for best nominal rates of bad credit business start up loans. Let us discuss all the relevant details about bad credit business loans.

Bad credit results from missed or non repayments in the earlier record. It leaves your credit record blemished with defaults, arrears, CCJ, IVA, or even bankruptcy. But, lenders completely understand the plea of the borrowers and are ready to offer a helping hand to those people.

You can make use of start up bad credit small business loans for any of your business purposes like starting a new business, coping with the losses of some past year, acquiring working capital and many more.

If you are looking for nominal rates of bad credit small business loans, then you apply for secured ones. For that purpose, you need to offer some of your assets as collateral to secure the loan amount. In case of any deferment in the repayment of the loan amount, your collateral will be seized by your lender.

In turn of this risk coverage factor, you will get lower rate of interest, longer repayment term, larger loan amount etc. For all such amazing benefits, all you need to do is be extra careful with the repayment schedule.

Make your search through various online sources for bad credit small business start up loans. Compare the quotes of bad credit small business start up loans offered by the different lenders, well and crack the best deal.

Bankruptcy Loans have certain requirements that affect all the loan terms in diverse ways. However, certain loan requirements affect particular loan terms significantly more than others. Knowing this will help you understand which type of loan you can request and what loans you have more chances of getting approved for.

Bankruptcy loan’s qualification is not an easy task. You need to overcome serious lender’s wariness about your ability and disposition for repaying the loan you are requesting. At this stage, you need to make no mistakes, your behavior has to be stainless and you need to show the lender that the past problems that led you to bankruptcy exist no more.

Earnings & Loan Installments

Your income will determine the amount of the loan installments you can cope with. The amount of the installments will never exceed 40% of your income. Thus, if your income is limited, you’ll need to reduce the monthly payments either by requesting smaller loan amounts or by extending the repayment period.

While lowering the amount of money you request will save you money on interests (though it may not provide you with all the finance you need), extending the repayment program will increase the amount of money you’ll spend on interests and it is not always feasible on bankruptcy loans due to the higher risk it implies.

Credit Score & Loan Amount

Your credit score will determine approval but it also determines the amount of money you can request. The lower your credit score, the less loan amount you’ll be approved for. This is due to the fact that your credit score is directly associated with the risk involved in the financial transaction and thus, the lender won’t like to endanger large amounts if he is not certain you’ll be able to repay the loan.

Though income is also related to loan amount, it has a more direct inference on the amount of the loan installments. As long as you repay the loan, the lender won’t mind extending the loan repayment program so you can afford the payments with a lower income. But this is only feasible if your credit score is good enough to qualify for the loan amount you seek.

Overall Risk & Loan Length As regards the loan length, it cannot be said that certain requirement has a special inference on it. The overall risk involved in the financial transaction will determine how long is the lender willing to wait to recover the money invested. Thus, getting a longer repayment schedule can easily be achieved by reducing the risk. This means that it can be done by modifying any of the requirements’ variables.

A longer repayment schedule can be obtained by raising your credit score, by offering a larger income, by offering some sort of collateral, by applying with the aid of a co-signer, etc. Loan length is not such an important variable as the other loan terms and is almost always negotiable. So, if you need a longer repayment program, you can always contact the lender and agree to refinance the loan.

Bankruptcy loan’s qualification is not an easy task. You need to overcome serious lender’s wariness about your ability and disposition for repaying the loan you are requesting. At this stage, you need to make no mistakes, your behavior has to be stainless and you need to show the lender that the past problems that led you to bankruptcy exist no more.

Earnings & Loan Installments

Your income will determine the amount of the loan installments you can cope with. The amount of the installments will never exceed 40% of your income. Thus, if your income is limited, you’ll need to reduce the monthly payments either by requesting smaller loan amounts or by extending the repayment period.

While lowering the amount of money you request will save you money on interests (though it may not provide you with all the finance you need), extending the repayment program will increase the amount of money you’ll spend on interests and it is not always feasible on bankruptcy loans due to the higher risk it implies.

Credit Score & Loan Amount

Your credit score will determine approval but it also determines the amount of money you can request. The lower your credit score, the less loan amount you’ll be approved for. This is due to the fact that your credit score is directly associated with the risk involved in the financial transaction and thus, the lender won’t like to endanger large amounts if he is not certain you’ll be able to repay the loan.

Though income is also related to loan amount, it has a more direct inference on the amount of the loan installments. As long as you repay the loan, the lender won’t mind extending the loan repayment program so you can afford the payments with a lower income. But this is only feasible if your credit score is good enough to qualify for the loan amount you seek.

Overall Risk & Loan Length As regards the loan length, it cannot be said that certain requirement has a special inference on it. The overall risk involved in the financial transaction will determine how long is the lender willing to wait to recover the money invested. Thus, getting a longer repayment schedule can easily be achieved by reducing the risk. This means that it can be done by modifying any of the requirements’ variables.

A longer repayment schedule can be obtained by raising your credit score, by offering a larger income, by offering some sort of collateral, by applying with the aid of a co-signer, etc. Loan length is not such an important variable as the other loan terms and is almost always negotiable. So, if you need a longer repayment program, you can always contact the lender and agree to refinance the loan.

personal consolidation loans

,

Guideline

,

PEPPERSTONE SPREAD

,

bankruptcy

,

Insurance

Popular Posts

-

Every small business knows how difficult it is for one to get a small business loan these days. With the economy being what it is, qualifyin...

-

Based on the complaints received from various students, ELTF finds that the banks do not classify NPA properly and unnecessarily blame the s...

-

Commencing a new business or expanding an existing one is not a matter of joke. For all such needs, you need huge amount of funds. And it is...

-

The following letter may be downloaded form IBA site http://www.iba.org.in/Documents/cirmembers%2027912.doc The latest IBA scheme may be dow...

-

ELTF has been getting lot of enquirers from different part of country seeking clarifications on 'Interest Subsidy Scheme'. There a...

-

Some people maybe will choose to take the loan to pay off credit cards . By choosing a personal loan that has lower rates that they are pay...

-

Bankruptcy Loans have certain requirements that affect all the loan terms in diverse ways. However, certain loan requirements affect particu...

-

To know more about education loan schemes in India, please download the ezine on Education Loan from the following link: http://www.prpoint....

-

ELTF has been getting lot of mails as to how public can complain when they do not get justice from the branches of banks. Normally, we com...

-

dear friends Members are aware that under India Vision group, we have formed Education Loan Task Force (ELTF) to create awareness about...

Blog Archive

Copyright © 2016 - My LOAN MAGAZINE - Template by FokusAds