My LOAN MAGAZINE

Home

blog categories

HomeAll posts

Some people maybe will choose to

take the loan to pay off credit cards. By choosing a personal loan that

has lower rates that they are paying on the credit cards, they can save some

money, but there are some things to consider before taking a loan to pay off

credit cards.

Some believe that when you take aloan to pay off credit cards is like a revolving dept. You borrow one to

complete one. It is almost the same. Revolving debt can be more dangerous for

your credit score and worse than installment debt. If you choose this way, you

may have converted revolving debt to installment debt. It can cause your scores

went up. Besides, the rate from the loan is not so different with the credit

cards. It depends on you to choose the secure an trusted loan. Some insecure

loan can cause some risks by the lenders. The lenders can put a very

high-interest charges. Some lenders are also looking for a person who has a good credit rating. If it's

not, you will be rejected.

When you want to take the loan to pay off credit cards, of course,

you will choose the loan that has lower rates, then after that, be sure that

you can handle the payments of the loan. Different with credit

card debt, a personal loan has a shorter time gradually than a credit card.

This condition can cause higher monthly payments. Don't make a transaction on a

payment schedule that you can't handle.

After you take a personal loan, you can immediately pay off your credit

card debt, it means that you have a new zeroed balances. Remember that you

still have to complete your loan debt, even though that it has lower rates. The

most important thing when you take the loan to pay off credit cards is to make

sure that you pay your loan debt in each month. The goal from this strategy is

to repay the principal and eliminate the debt. To use this way, you should make

a good money management to avoid a bigger dept from the loan, than the credit

cards.

Pepperstone is an Online Forex (FX) Trading Broker, providing traders across the globe with cutting edge forex trading technology to offer unmatched top tier liquidity, institutional grade spreads and the security of tight financial regulation. Pepperstone offers online forex trading through multiple forex trading platforms, including Metatrader 4, Webtrader and Apps for iPhone and Android.

Smart traders make smart decisions. Equip yourself with the Pepperstone advantage today.

1. Raw ECN Spreads from 0.1 pips

2. Industry leading $3.5AUD per 100k traded

3. 400:1 Leverage

4. $200 minimum deposit

5. Trade from 0.01 lots

Secure Fund

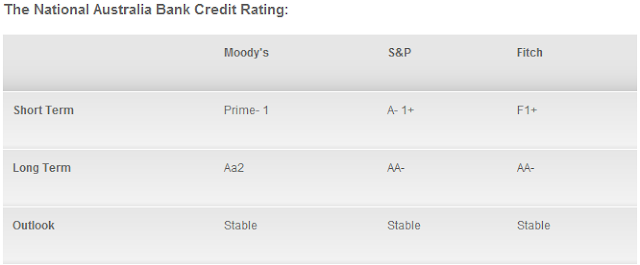

Client funds held in segregated trust accounts with AA Rated Australian Banking Institutions

Tip Tier Liquidity

Next-generation STP access to one of the largest pools of interbank liquidity in the world.

Metatrader 4

Trade using the Metaquotes MT4 Platform with no trading restrictions and lightning fast execution

RAGULATED

Open an account with a regulated firm, so you can focus on what's important: your trading.

How are my funds held with Pepperstone?

Your funds on deposit with Pepperstone are held in a trust accounts with the National Australia Bank, anAA rated Bank. Funds are established, maintained and operated in accordance with Australian client money rules.

License

Pepperstone Financial Pty Ltd holds the Australian Financial Services License AFSL 414530.

ASIC requires licensed financial services providers to meet strict capital requirements and to implement and comply with internal procedures including risk management, staff training, accounting and audits.

Trading with Pepperstone

Australian-based forex trading firm

Regulated under ASIC

Professional Indemnity Insurance with Lloyds of London

Professional Memberships

Pepperstone Financial Pty Ltd is a member of the Financial Ombudsman Service (FOS), which is an approved Australian external dispute resolution scheme that can deal with complaints about all of the financial services under its AFSL.

Segregation of Client Funds

All client funds are segregated into client trust accounts kept separate from the Pepperstone company funds.

Bank Accounts in Tier-1 Banks

All client funds are kept in the safest top-tier AA rated banks*.

*Pepperstone partners with The National Australia Bank, an AA Rated Ban

Working people are really struggling to make ends meet with the economy in such an uproar. If you are among those who have been hit really hard with a combination of escalating gasoline prices and soaring food prices, chances are you may be running a little short financially before you next payday rolls around. There are loans for people in your situation that can lend you a hand and keep your household running until you get paid again.

Money Today For Any Purpose

These loans are called payday loans. It is a short-term loan that can make a big difference for working people. They are easy to obtain and easy to repay. Although there may be walk-in stores in your area that service payday loans, you can get the best rates online, where lenders compete for customers.

The way they work is simple. You present your lender with a post dated check for the amount you want to borrow, plus interest and fees. The servicer will hold your payday loan for an agreed upon period of time, anywhere from two weeks to one month, which will coincide with your next pay day. When your payday loan becomes due, your post dated check will be deposited into your checking account in order to reimburse the lender for your money. It really is that simple.

Everyone Qualifies

The requirements to get a payday loan are so lax that nearly everyone can receive one. If you have income in the form of wages (or in some cases, even disability income) and a valid checking account that is not overdrawn, you can expect to be approved.

When applying, you will be asked to submit proof of your income in the form of recent paystubs, or other verification; a valid state issued drivers license card, proof of your residence in the form of a recent utility or phone bill, credit card statement, or other official piece of mail; and three personal references who will only be called if you should fail to repay the lender.

No Credit Check

There is no credit check required to receive a payday loan, which means that regardless of how bad your credit may be, you can still get the money you need today. Be aware, however, that payday loans do not report to the major credit reporting bureaus (unless you default), so this type of loan cannot be counted on to help build or rebuild your credit score.

Payday loans have gotten a bad reputation in recent years, with many claims that the interest borrowers pay is too high in relation to the benefit they receive from the loan. This interest is far less when you get your payday loan online, and it is notable that any payday loan, regardless of the interest that you must pay, is superior to the outcome of not having the funds to pay for things you must have - such as having your electricity shut off, not having gas to get to your job, or even writing checks that are returned for non-sufficient funds.

Commencing a new business or expanding an existing one is not a matter of joke. For all such needs, you need huge amount of funds. And it is almost impossible in the present world to arrange such huge amount on ones own. At such crucial point of time, an obvious choice is seeking refuge in some external source like applying for loans. But, you might be facing problem because of your bad credit.

These days, there is no dearth of lenders offering business loans, in spite of your bad credit record. Here are few tips on where to make your search for best nominal rates of bad credit business start up loans. Let us discuss all the relevant details about bad credit business loans.

Bad credit results from missed or non repayments in the earlier record. It leaves your credit record blemished with defaults, arrears, CCJ, IVA, or even bankruptcy. But, lenders completely understand the plea of the borrowers and are ready to offer a helping hand to those people.

You can make use of start up bad credit small business loans for any of your business purposes like starting a new business, coping with the losses of some past year, acquiring working capital and many more.

If you are looking for nominal rates of bad credit small business loans, then you apply for secured ones. For that purpose, you need to offer some of your assets as collateral to secure the loan amount. In case of any deferment in the repayment of the loan amount, your collateral will be seized by your lender.

In turn of this risk coverage factor, you will get lower rate of interest, longer repayment term, larger loan amount etc. For all such amazing benefits, all you need to do is be extra careful with the repayment schedule.

Make your search through various online sources for bad credit small business start up loans. Compare the quotes of bad credit small business start up loans offered by the different lenders, well and crack the best deal.

Bankruptcy Loans have certain requirements that affect all the loan terms in diverse ways. However, certain loan requirements affect particular loan terms significantly more than others. Knowing this will help you understand which type of loan you can request and what loans you have more chances of getting approved for.

Bankruptcy loan’s qualification is not an easy task. You need to overcome serious lender’s wariness about your ability and disposition for repaying the loan you are requesting. At this stage, you need to make no mistakes, your behavior has to be stainless and you need to show the lender that the past problems that led you to bankruptcy exist no more.

Earnings & Loan Installments

Your income will determine the amount of the loan installments you can cope with. The amount of the installments will never exceed 40% of your income. Thus, if your income is limited, you’ll need to reduce the monthly payments either by requesting smaller loan amounts or by extending the repayment period.

While lowering the amount of money you request will save you money on interests (though it may not provide you with all the finance you need), extending the repayment program will increase the amount of money you’ll spend on interests and it is not always feasible on bankruptcy loans due to the higher risk it implies.

Credit Score & Loan Amount

Your credit score will determine approval but it also determines the amount of money you can request. The lower your credit score, the less loan amount you’ll be approved for. This is due to the fact that your credit score is directly associated with the risk involved in the financial transaction and thus, the lender won’t like to endanger large amounts if he is not certain you’ll be able to repay the loan.

Though income is also related to loan amount, it has a more direct inference on the amount of the loan installments. As long as you repay the loan, the lender won’t mind extending the loan repayment program so you can afford the payments with a lower income. But this is only feasible if your credit score is good enough to qualify for the loan amount you seek.

Overall Risk & Loan Length As regards the loan length, it cannot be said that certain requirement has a special inference on it. The overall risk involved in the financial transaction will determine how long is the lender willing to wait to recover the money invested. Thus, getting a longer repayment schedule can easily be achieved by reducing the risk. This means that it can be done by modifying any of the requirements’ variables.

A longer repayment schedule can be obtained by raising your credit score, by offering a larger income, by offering some sort of collateral, by applying with the aid of a co-signer, etc. Loan length is not such an important variable as the other loan terms and is almost always negotiable. So, if you need a longer repayment program, you can always contact the lender and agree to refinance the loan.

Bankruptcy loan’s qualification is not an easy task. You need to overcome serious lender’s wariness about your ability and disposition for repaying the loan you are requesting. At this stage, you need to make no mistakes, your behavior has to be stainless and you need to show the lender that the past problems that led you to bankruptcy exist no more.

Earnings & Loan Installments

Your income will determine the amount of the loan installments you can cope with. The amount of the installments will never exceed 40% of your income. Thus, if your income is limited, you’ll need to reduce the monthly payments either by requesting smaller loan amounts or by extending the repayment period.

While lowering the amount of money you request will save you money on interests (though it may not provide you with all the finance you need), extending the repayment program will increase the amount of money you’ll spend on interests and it is not always feasible on bankruptcy loans due to the higher risk it implies.

Credit Score & Loan Amount

Your credit score will determine approval but it also determines the amount of money you can request. The lower your credit score, the less loan amount you’ll be approved for. This is due to the fact that your credit score is directly associated with the risk involved in the financial transaction and thus, the lender won’t like to endanger large amounts if he is not certain you’ll be able to repay the loan.

Though income is also related to loan amount, it has a more direct inference on the amount of the loan installments. As long as you repay the loan, the lender won’t mind extending the loan repayment program so you can afford the payments with a lower income. But this is only feasible if your credit score is good enough to qualify for the loan amount you seek.

Overall Risk & Loan Length As regards the loan length, it cannot be said that certain requirement has a special inference on it. The overall risk involved in the financial transaction will determine how long is the lender willing to wait to recover the money invested. Thus, getting a longer repayment schedule can easily be achieved by reducing the risk. This means that it can be done by modifying any of the requirements’ variables.

A longer repayment schedule can be obtained by raising your credit score, by offering a larger income, by offering some sort of collateral, by applying with the aid of a co-signer, etc. Loan length is not such an important variable as the other loan terms and is almost always negotiable. So, if you need a longer repayment program, you can always contact the lender and agree to refinance the loan.

Ministry of Human Resources Development (MHRD), Government of India has extended the date for submission of claims by banks up to 10th October 2015. The eligible students may contact their Branch Managers to ensure that claims have been submitted or their names have been included for submission. This is an one-time opportunity provided by MHRD to all the Banks to rectify their earlier mistakes.

If the Branch Managers say that they have not received any information from their Head Office, the students can politely request them to verify with their Head Office or Zonal Office. If the students / parents do not receive proper response from the Branch Managers, they can meet the concerned Zonal Managers and submit a letter in writing to the Zonal Manager.

ELTF gets frequent complaints that some Branch Managers deny interest subsidy to eligible students on the ground that the student had paid the interest, had not paid interest, or closed the loan account, etc. If the student is otherwise eligible for interest subsidy, as per the scheme, then they cannot be denied the subsidy under different assumed reasons. In such cases, the students can complain to the Chairman of the Bank and RBI immediately without any delay. Before making such complaint, the students should give opportunity to the Manager to verify with their higher officials.

ELTF gets frequent complaints that some Branch Managers deny interest subsidy to eligible students on the ground that the student had paid the interest, had not paid interest, or closed the loan account, etc. If the student is otherwise eligible for interest subsidy, as per the scheme, then they cannot be denied the subsidy under different assumed reasons. In such cases, the students can complain to the Chairman of the Bank and RBI immediately without any delay. Before making such complaint, the students should give opportunity to the Manager to verify with their higher officials.

They can also send a written complaint to the Branch Manager, Zonal Manager and the Chairman of the Bank through Speed Post, if the Branch is not providing proper information or guidance. It is the duty of all the Branch Managers to provide the information to the students. The Branch is required to give all clarifications to the students.

Please go through the following three links to get better understanding.

Pending interest subsidy claims from 1.4.2009 to 31.3.2014 can be submitted as one time measure.

Clarifications on Education Loan Interest Subsidy Scheme (CSI)

Portal opened for claiming unclaimed interest subsidy

http://www.eltf.in/2015/09/portal-opened-for-claiming-unclaimed.html

Please avoid contacting ELTF through mail or personally without going through the site and without attempting to resolve your grievance at Bank level.

Please avoid contacting ELTF through mail or personally without going through the site and without attempting to resolve your grievance at Bank level.

Nodal Bank Canara Bank has today (7th Sep 2015) opened the portal for claiming, unclaimed Education Loan interest subsidy for the loans disbursed during 2009-10 to 2013-14. This is an one time opportunity for all Banks to claim the left out interest subsidy claims. The portal will remain open for 30 days from today.

Eligibility

Government of India, Ministry of HRD is implementing Educational Loan Interest Subsidy Scheme from 2009-10. Economically weaker section students whose parental income is less than Rs.4.50 lakhs, pursuing professional and technical courses in India are eligible for 100% interest subsidy during the moratorium period, when they avail education loan under IBA model scheme. Moratorium period is the study period plus one year or six months after getting employment whichever is earlier.

We have written in detail about the eligibility in the following link.

Claim for old cases (2009-10 to 2013-14)

The students who are eligible for interest subsidy and who have not received the subsidy earlier may contact the Branch Manager and submit a letter requesting him to submit the claim. If the Branches says that they have not received any communication from their Head Office, the students can politely ask them to check up with their head office. Still if the Branches do not respond, the students can complain directly to the Regional Manager and Chairman of the Bank. If the claim is not submitted by the Banks for old cases before 10th October 2015, the eligible students cannot claim the interest subsidy later.

The copy of the IBA letter is as follows:

Quote

No.RB/CIR/CSIS/26

9th September, 2015

VERY URGENT

To:

The Chief Executives of Member Banks

Dear Sir/Madam,

Web Portal Open from 7.9.2015 to 10.10.2015 - Last option to claim subsidy for old cases under CSIS

We invite your kind attention to our circular No.RB/CIR/CSIS/15 dated 26th August, 2015 regarding old pending claims in respect of ALL THE ELIGIBLE unclaimed cases [including SC/ST and General Category] for the period from the year 01.04.2009 to 31.03.2014 as a onetime measure. This will be the final chance (copy enclosed).

In this connection, we have now been informed that, the Nodal Bank viz. Canara Bank would keep the web portal open for the period from 7.9.2015 to 10.10.2015 (both days inclusive) for uploading of leftover CSIS claims by the member banks for the year viz. 2009-10, 2010-11, 2011-12, 2012-13 and 2013-14.

We therefore, request all our member banks to upload all eligible left over claims at an early date, as there will not be any further opportunity for the same as per the instructions of MoHRD, Government of India.

Please note that the CSIS Scheme is also applicable to RRBs, we request all sponsoring Public Sector Banks to inform their respective RRBs to take necessary action in the matter.

Please be guided accordingly with immediate effect.

Yours faithfully,

K Unnikrishnan

Dy. Chief Executive

Unquote

The copy of the IBA letter is as follows:

Quote

No.RB/CIR/CSIS/26

9th September, 2015

VERY URGENT

To:

The Chief Executives of Member Banks

Dear Sir/Madam,

Web Portal Open from 7.9.2015 to 10.10.2015 - Last option to claim subsidy for old cases under CSIS

We invite your kind attention to our circular No.RB/CIR/CSIS/15 dated 26th August, 2015 regarding old pending claims in respect of ALL THE ELIGIBLE unclaimed cases [including SC/ST and General Category] for the period from the year 01.04.2009 to 31.03.2014 as a onetime measure. This will be the final chance (copy enclosed).

In this connection, we have now been informed that, the Nodal Bank viz. Canara Bank would keep the web portal open for the period from 7.9.2015 to 10.10.2015 (both days inclusive) for uploading of leftover CSIS claims by the member banks for the year viz. 2009-10, 2010-11, 2011-12, 2012-13 and 2013-14.

We therefore, request all our member banks to upload all eligible left over claims at an early date, as there will not be any further opportunity for the same as per the instructions of MoHRD, Government of India.

Please note that the CSIS Scheme is also applicable to RRBs, we request all sponsoring Public Sector Banks to inform their respective RRBs to take necessary action in the matter.

Please be guided accordingly with immediate effect.

Yours faithfully,

K Unnikrishnan

Dy. Chief Executive

Unquote

Claim for 2014-15

The portal for claiming interest subsidy for 2014-15 is already open and will be closed on 25th Sep 2015.

The eligible students can also confirm with their Branches that their eligible interest subsidy for 2014-15, I repeat for 2014-15 has been submitted to the nodal bank. If not submitted, they have to submit before 25th Sep 2015. Banks should claim 100% of the interest charged by them, as subsidy for eligible students.

In both the cases (old and current), if the claims are not submitted the branches within the due date, the students will not get the interest subsidy. In their own interest, students are advised to check with their Branches. If they need further help or clarification, they have to approach only the higher officials of the Bank.

ELTF does not follow up with individual cases. Please do not write to us or try to contact us. The students have to take up only with Bank officials.

ELTF has been getting lot of enquirers from different part of country seeking clarifications on 'Interest Subsidy Scheme'.

There are two types of Interest Subsidy scheme for students pursuing education in India.

1. First Scheme: For Loans granted / disbursed on or after 1st April 2009;

2. Second Scheme: For Loans granted / disbursed prior to 1st April 2009;

Eligibility

For both the Schemes, the eligibility is as follows:

a) The Education Loan should have been sanctioned under IBA Scheme;

b) The Loan should have been granted to pursue professional or technical courses in approved Institutions after 12th std. (Diploma students joining Engineering Courses through lateral entry are also eligible);

c) The education should be within India;

d) The gross parental income should be less than 4.50 lakhs.

For Loans granted prior to 1.4.2009

In Feb 2014, Shri P Chidambaram (then Finance Minister) announced in the Parliament that Government would reimburse 100% of the interest outstanding as on 31.12.2013. Canara Bank was appointed as Nodal Bank to pool the data. Interest component on all eligible loans outstanding as on 31.12.2013 were paid by the Government to the Banks and credited to the loan accounts.

In this scheme, the students who availed loan prior to 1.4.2009 and who paid the interest regularly, were in a disadvantageous position. Since interest component was either nil or negligible, they did not get any benefit of the interest subsidy. Similarly the students who closed the education loan account before 31.12.2013 were also not eligible to get interest subsidy.

Now this scheme is closed. Now the students cannot claim any interest subsidy under this scheme. We are writing this only for information.

For Loans granted / disbursed on or after 1.4.2009

Government of India (Ministry of HRD) provides 100% interest subsidy for the eligible students (as given earlier) for all the loans disbursed on or after 1.4.2009 during the moratorium period.

If a loan has been sanctioned in 2007 for Rs.4 lakhs, to be disbursed @ Rs. 1 lakh every year, the student is eligible for interest subsidy for the disbursements made in 2009 (if it is after 1.4.2009) and 2010.

Moratorium period is the study period + one year of six months after getting employment whichever is earlier.

Interest subsidy is available for either Under Graduation or Post Graduation. From the same family, brothers and sisters can avail the subsidy individually.

Students can avail the subsidy under only one scheme. Students who availed subsidy under the second scheme (loans prior to 1.4.2009) are not eligible for subsidy under the first scheme.

Please go through the guidelines in this links very carefully.

Problems faced by students

The students were required to submit the Income Certificate to the Bank to claim interest subsidy. Since the Banks did not intimate many of the students in the early years, many eligible students did not get interest subsidy.

It is the duty of the Banks to identify the eligible students and advise them to get the income certificate. Also, it is the duty of the Bank to submit the claim through the Nodal Bank portal to the Government of India within the time stipulated by the Government. Due to the fault of many of the Branches, claims were not submitted in the past claiming interest subsidy by the Banks.

Even the students who got subsidy, received only a small portion of the interest debited by the Bank. In many cases, Banks failed to submit the claim for few years. For example, banks might not have claimed for 2009-10, but claimed for other years. Also, they might have claimed for 2009-10, 2010-11, but might not have claimed for other eligible years during the moratorium period.

ELTF has been taking up this issue through supporting MPs in the Parliament and with the Government for the past three years.

The eligible students can check the status of their interest subsidy through this link

https://epayment.canarabank.in/MHRD/CSISACDetails.aspx

(Some students may get 'Data not available' message. In that case, the students have to approach only the Bank manager for details. It is the responsibility of the Bank Managers to provide the claim related details to the students.)

(Some students may get 'Data not available' message. In that case, the students have to approach only the Bank manager for details. It is the responsibility of the Bank Managers to provide the claim related details to the students.)

Government of India opens the portal as one time measure

In order to resolve the confusion of the past disbursement of Interest Subsidy, the Government of India (MHRD) has now permitted the Nodal Bank Canara Bank to open their portal to enable the Banks to file the claim.

Accordingly, all the pending claims, unclaimed interest subsidy for the period from 2009-10 to 2013-14 can now be claimed by the Banks. Though the portal was supposed to have been opened on 1st Sep 2015, due to some technical reasons, it is likely to be opened next week. Please keep watching this site and our Facebook page for latest updates.

https://www.facebook.com/EducationLoanTaskForce

(Update: The Portal is opned on 7th Sep 2015 and will remain open till 10th October 2015)

(Update: The Portal is opned on 7th Sep 2015 and will remain open till 10th October 2015)

What students can do

If you have any education loan disbursement on or after 1.4.2009 (irrespective of your date of sanction say 2008 or 2007) and if you are eligible for interest subsidy as given in the early paras, then check your statement of account and also through the link given above for the subsidy claimed by the Bank.

Please compare the actual interest debited by the Bank during that Financial Year with the interest credited or not credited. If the students find that either interest subsidy for that year has not been claimed or shortly credited, please write a letter giving the complete details and hand over to the Manager. Please request the Manager to claim the interest subsidy, when the portal opens.

If the students get a response from the Managers that they have not received any instructions from the Head Office, the students can send their request to the Chairman of the Bank, Regional Manaer and to the Branch under Registered Post. You can also mention that the Manager refused to accept the request. You can request the Managers to claim the interest as and when the portal gets opened, after verifying the correctness.

If required, the students can meet the Regional Manager and submit a letter personally. Though it is the duty of the Bank Manager to identify and submit the claim, to avoid any future confusion, ELTF suggests that students themselves can verify and draw the attention of the Managers.

For the latest IBA guideline, please click

ELTF will not follow up individual cases. If the students find any difficulty, they have to send complaint to Chairman of the Bank and to Reserve Bank of India. Please do not write to ELTF for individual issues. They can personally meet the Regional Managers and sort out the issues.

This is an one time measure allowed by the Government. Hence, students and banks should avail the opportunity so that all the pending cases are resolved.

This is an one time measure allowed by the Government. Hence, students and banks should avail the opportunity so that all the pending cases are resolved.

By K Srinivasan, Convenor, ELTF

Under instructions from MHRD, Indian Banks' Association has notified that all pending interest subsidy claims (1.4.2009 to 31.3.2014) belonging to SC/ST and General category can be submitted immediately by the bank branches to the nodal bank.

The eligible students, who did not get the interest subsidy earlier may immediately meet the Manager and submit a letter of request to the Bank. They can also give the copy of the notification to the branches. If the Branch Managers do not respond positively, the students can report to the Chairman of the Bank and also to Reserve Bank of India.

Canara Bank will open the portal on 1st Sep 2015 and close on 15th Sep 2015. The eligible students may meet the Bank Manager and give a letter requesting him to submit the pending claims within the due date.

Canara Bank will open the portal on 1st Sep 2015 and close on 15th Sep 2015. The eligible students may meet the Bank Manager and give a letter requesting him to submit the pending claims within the due date.

The copy of the notification:

No RB/CIR/CSIS/15

26th August, 2015

VERY URGENT

To:

The Chief Executives of Member Banks

Dear Sir/Madam,

Opening of CSIS portal for claiming CSIS subsidy for

OLD CASES-final chance

The Ministry of HRD vide their communication dated 20th August, 2015 has advised to keep the web portal open and sensitize all the banks that, this is the last opportunity for banks to lodge the claims and ensure that the eligible students who have availed education loans are not deprived of the benefit of interest relief. The Ministry of HRD has requested IBA to advise members banks that portal will be opened for lodging all old pending claims in respect of ALL THE ELIGIBLE unclaimed cases [including SC/ST and General Category] for the period from the year 01.04.2009 to 31.03.2014 as a onetime measure. This will be the final chance.

Accordingly, the Nodal bank viz. Canara Bank has informed us that they are in process of opening the CSIS Web Portal for submission of the old pending / left over cases and will be informing the date of the opening of portal very soon.

In the meantime, we request all the members to please keep the required details ready for submission of the eligible claims. KINDLY NOTE THAT THIS WILL BE THE FINAL ONETIME MEASURE AND THERE WILL BE NO MORE OPPORTUNITY TO CLAIM THE CSIS SUBSIDY for the old claims for the period from the year 01.04.2009 to 31.03.2014.

Please note that the CSIS Scheme is also applicable to RRBs, we request all sponsoring Public Sector Banks to inform their respective RRBs to take necessary action in the matter.

Please be guided accordingly with immediate effect.

Yours faithfully,

K Unnikrishnan

Dy. Chief Executive

All Bank Branches should submit the interest subsidy claims for 2014-15 before 25th September 2015. Though it is the duty of all the branch managers to submit the claim to the nodal bank Canara Bank before the due date, in the past, due to various reasons, managers have not submitted the claims properly. This has resulted in many eligible poor students not getting the interest subsidy from the Government.

Students who have availed education loans under IBA Scheme pursuing professional or technical courses in the approved institutions and whose annual parental income is less than Rs.4.50 lakhs are eligible for 100% interest subsidy during the moratorium period. They should have submitted the income certificate duly signed by Thasilldar.

Eligible students may meet the branch managers and get the confirmation that the Branch has included their name and the exact amount (100% of interest charged during 2014-15). The students can also submit a letter to the Managers seeking confirmation for having submitted the claim. They can endorse a copy to the concerned Regional Managers and the Branch Managers. We are suggesting this as an abundant caution.

If the Branch Managers refuse to give proper information, the students can write a complaint to the Chairman of the Bank and to the Regional Manager.

We are receiving complaints that some of the banks are not processing / sanctioning the Education loan applications if the applicants do not submit the AADHAR card. When we sought clarification from the Nodal Bank Canara Bank, Shri Badrinath, AGM, Canara Bank Head Office has responded to us the following quoting IBA guidelines. From these guidelines, it is clear that Aadhar cards are not mandatory for processing the education loan applications.

quote

IBA Mumbai during the revision of Education loan scheme guidelines had advised banks to Obtain UID number issued by UIDAI ( Aadhaar ) to the students and note the same in the System.

Accordingly we had issued guidelines to the branches to prevail upon the students to submit the PAN/AADHAAR card particulars before completion of the course.

Wherever a student is not having UID number, branches are advised to obtain undertaking letter from the student for submission at a later specified date. However, the disbursement in subsequent years should not be stopped for the said reason. The same should be followed up till submission for noting in records.

From the above , it is clear that obtention of AADHAAR card is neither mandatory nor a condition for sanction of loan.

UnQuote

Mr Unnikrishnan, Deputy Chief Executive of Indian Banks' Association has further clarified as follows:

Quote

Aadhar is not mandatory for sanction of Education loan, but students are advised to submit Aadhar before completion of course.

Unquote

Finally, you got personal loans for bad credit to meet you devouring demands. First of all, it is important for you to understand the nature of your personal loan. Personal loans are unlike to a home loan or a car loan. It means that you do not have to offer any collateral to secure the loan. For the reason, the personal loan becomes inherently risky for a lending institution to provide loan to the people in deep credit deficits.

For all that you need to determine if you are able to qualify for personal loans in your bad credit state. You need to fill out an application form in this regard. The application is made possible online as well as offline, processing online is preferred though. This loan form takes into account of your name, Social Security number, income, and other relevant information. Later, your credit worthiness is determined by a loan officer in the face of your bad credit history.

The loan officer can even assist you in making your application more appealing. He can make is more attractive by encouraging you to borrow a smaller amount of money. As well as, he can suggest you to make payments over a longer span of time. Moreover, the loan officer can also suggest the right way to lower down your monthly payments.

You are able to borrow a great deal more money from a high street lender than you would be able to borrow otherwise from a traditional bank. However, your chances are bright enough to secure up to $15,000 for a period ranges in 6 months to 10 years. You may be able to get an APR for as low as 7.99 percent. You can even shop around for the best possible deal also.

People who do not possess any property to keep against the loan amount can apply for personal loans for bad credit. They do not need to place any collateral as well as credit statement for securing the loan amount. So, in all the personal loans for bad credit borrowers provide fair financial benefits.

For all that you need to determine if you are able to qualify for personal loans in your bad credit state. You need to fill out an application form in this regard. The application is made possible online as well as offline, processing online is preferred though. This loan form takes into account of your name, Social Security number, income, and other relevant information. Later, your credit worthiness is determined by a loan officer in the face of your bad credit history.

The loan officer can even assist you in making your application more appealing. He can make is more attractive by encouraging you to borrow a smaller amount of money. As well as, he can suggest you to make payments over a longer span of time. Moreover, the loan officer can also suggest the right way to lower down your monthly payments.

You are able to borrow a great deal more money from a high street lender than you would be able to borrow otherwise from a traditional bank. However, your chances are bright enough to secure up to $15,000 for a period ranges in 6 months to 10 years. You may be able to get an APR for as low as 7.99 percent. You can even shop around for the best possible deal also.

People who do not possess any property to keep against the loan amount can apply for personal loans for bad credit. They do not need to place any collateral as well as credit statement for securing the loan amount. So, in all the personal loans for bad credit borrowers provide fair financial benefits.

|

| Dr Anbumani Ramadoss MP (third from left), Prime Point Srinivasan (fourth from left) |

Dr Anbumani Ramadoss (Former Union Health Minister and sitting MP of Dharmapuri, Tamil Nadu) organised an unique event on 1st June 2015 at Dharmapuri to create awareness about education loan among the students and parents. He had also invited all the local Bank Managers.

Probably this is the first time, a sitting MP is organising such awareness programme anywhere in India for the benefit of people in his constituency. They made a wide publicity through media, banners and pamphlets. More than 300 students and parents participated in this event.

Prime Point Srinivasan, Convenor of Education Loan Task Force (ELTF) was the Chief Guest and he delivered a talk on various aspects of Education Loan guidelines. This event helped to ease the tension between the bankers and the public and to understand each others difficulties.

Two important things observed was that though Reserve Bank of India and Indian Bank Head Office specifically advised all the banks not to follow 'service area concept' for education loans, Lead District Manager of Indian Bank openly admitted in the meeting that they were following service area concept for their convenience. However, ELTF has taken up the issue with Indian Bank Head Office.

Secondly, the local State Bank of India has not been granting any education loans presently citing bad debts. This matter is also being taken up by ELTF with State Bank of India Chairman.

While addressing the gathering, Srinivasan explained the application procedures, eligibility of interest subsidy, grievance redressal mechanism, etc.

While summing up the views, Dr Anbumani MP said that this programme was more a sensitization programme for both bankers and the students. He also assuired to take up with Finance Minister the mess up of interest subsidy matter.

This event was an unique event which can be emulated by other MPs and MLAs in their constituencies. Another important matter which needs 'three cheers' is the total neutrality of the programme. Though Dr Anbumani is the leader of a big political party, his team ensured that no political colour was given to the event.

Some of the photos:

A personal consolidation loan is a product that is growing in both need and demand today. As credit has become a dominant part of the American lifestyle, it has reeled the economy as well as personal lives with its pros as well as its cons. One of the greatest drawbacks of easy credit approval is that subjects are not adequately taught financial management skills. Before one knows it, they have more bills than they can pay and quickly drowning in their financial troubles.

A personal credit consolidation loan is a great way to start sweeping away some of the credit mess left by excess credit cards and other unsecured debt. You can trade out high interest rates, late charges and other fees for a clean, monthly payment that is easy to keep up with and that you can afford every month. A personal consolidation loan has been the reason many people have been saved from having to file for bankruptcy. The sooner you get started on your new loan program, the easier it will be for you to start straightening out your finances again.

A personal consolidation loan works by paying off all of your current debt. This helps your credit by reflecting all of your accounts as paid in full. In its place, you will get one lump loan at a lower interest rate than you were currently paying to all of your debtors. You can select a payment plan that you can afford, and manage just one monthly payment.

Insurance

Popular Posts

-

Commencing a new business or expanding an existing one is not a matter of joke. For all such needs, you need huge amount of funds. And it is...

-

Every small business knows how difficult it is for one to get a small business loan these days. With the economy being what it is, qualifyin...

-

The following letter may be downloaded form IBA site http://www.iba.org.in/Documents/cirmembers%2027912.doc The latest IBA scheme may be dow...

-

Based on the complaints received from various students, ELTF finds that the banks do not classify NPA properly and unnecessarily blame the s...

-

ELTF has been getting lot of enquirers from different part of country seeking clarifications on 'Interest Subsidy Scheme'. There a...

-

Some people maybe will choose to take the loan to pay off credit cards . By choosing a personal loan that has lower rates that they are pay...

-

Bankruptcy Loans have certain requirements that affect all the loan terms in diverse ways. However, certain loan requirements affect particu...

-

Nodal Bank Canara Bank has today (7th Sep 2015) opened the portal for claiming, unclaimed Education Loan interest subsidy for the loans disb...

-

To know more about education loan schemes in India, please download the ezine on Education Loan from the following link: http://www.prpoint....

-

ELTF has been getting lot of mails as to how public can complain when they do not get justice from the branches of banks. Normally, we com...

Blog Archive

Copyright © 2016 - My LOAN MAGAZINE - Template by FokusAds